self employment tax deferral covid

In response to coronavirus the Treasury IRS and federal government have announced several coronavirus relief and stimulus packages for individuals the self-employed. IR-2021-31 February 8 2021.

Irs Publishes Q As On Filing Deadline Extension Alloy Silverstein

The provision let you defer payment of the employer.

. The Coronavirus Aid Relief and Economic Security Act CARES Act allowed self-employed individuals to defer payment of certain self-employment taxes on income subject to. You can reasonably allocate 77500 775 x 100000 to the deferral period March 26 2020 to. The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on their Form 1040.

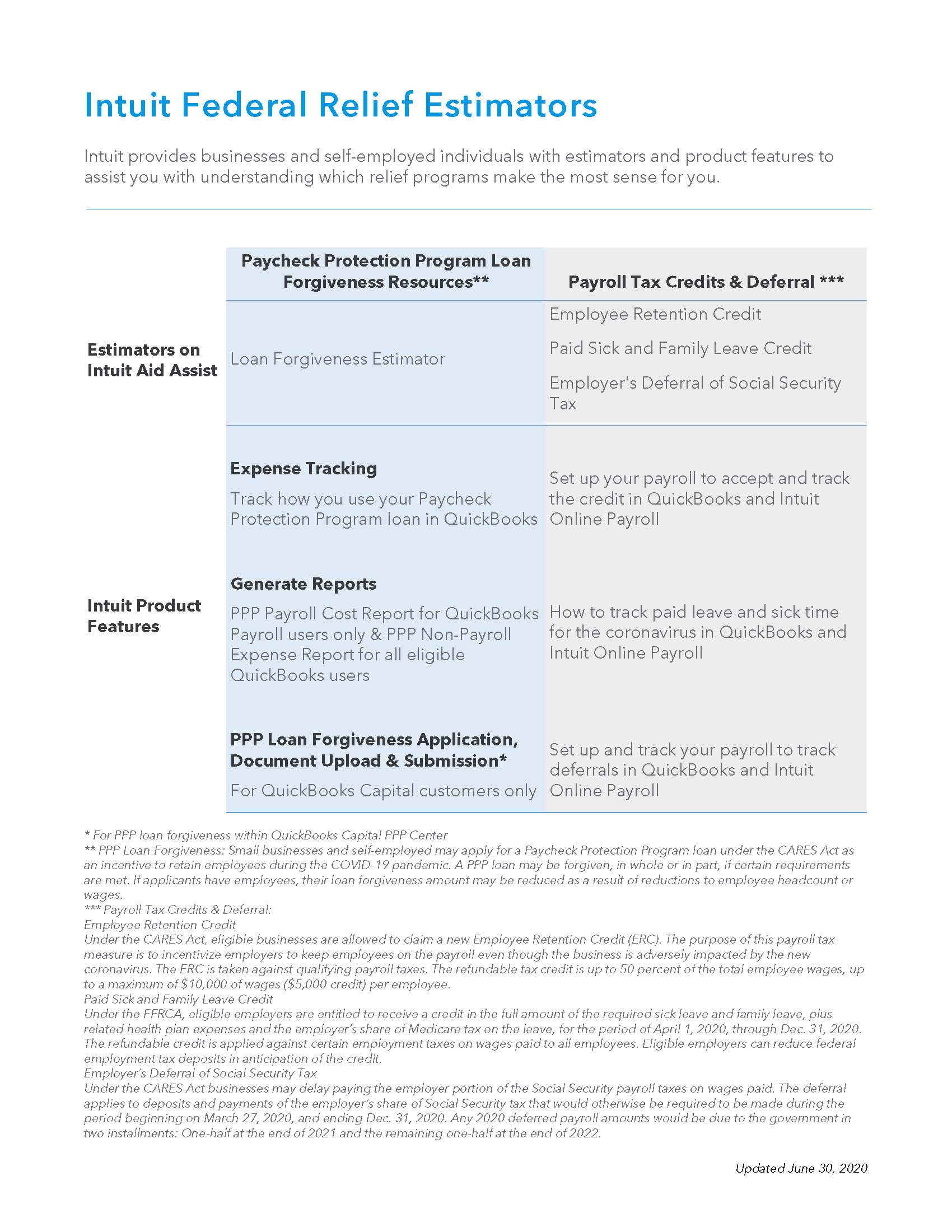

Regarding payment the recently released draft Year 2020 Form 1040 Schedule 3 includes a line item for the self-employed and household employers to remit the deferred. How a payroll tax relief deferral may help self-employed people. The COVID-related Tax Relief Act of 2020 enacted December 27 2020 amended and extended the tax credits and the availability of advance payments of the tax credits for paid sick and.

COVID Tax Tip 2021-32 March 10 2021. The Families First Coronavirus Response Act FFCRA provides refundable credits worth up to 15110 to self-employed individuals who lost income due to COVID-19. Estimate how much cash you.

Many small business owners and self-employed individuals have been affected by Coronavirus COVID-19. It was last edited on August 23 2021. Ad See What Youve Been Missing.

Use QuickBooks Self-Employed To Help You Get Your Business Up And Running. The FFCRA provides businesses with tax credits to cover certain costs of providing employees with paid sick leave and expanded family and medical leave for reasons related to. Lets say your net self-employment earnings for 2020 are 100000.

Nearly all businesses and self-employed individuals were eligible for the employer payroll tax deferral. Under the CARES Act employers were allowed to defer the. This article refers to provisions covered under the CARES Act of 2020.

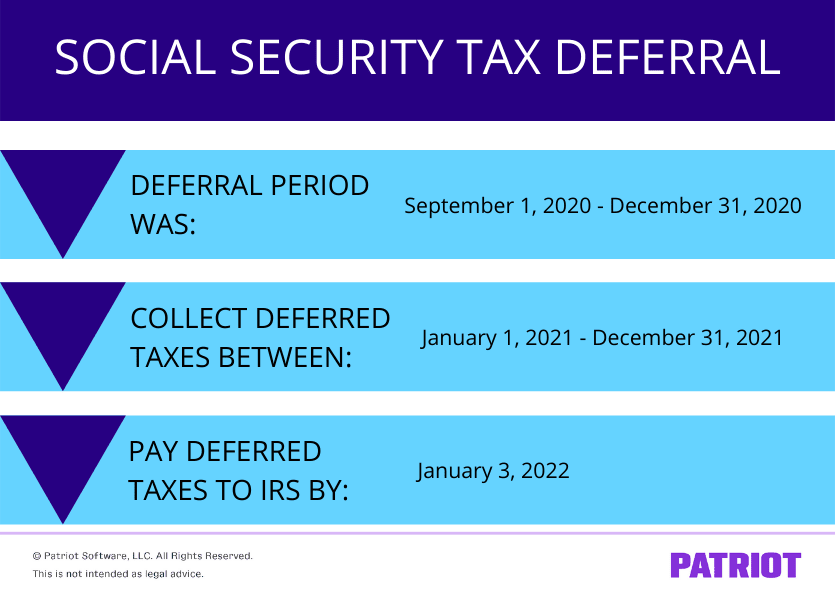

If you have employees you can defer the 62 employer portion of Social Security tax for March 27 2020 through December 31 2020. IR-2021-256 December 27 2021 WASHINGTON The Internal Revenue Service today reminded employers and self-employed individuals that chose to defer paying part of. To give people a needed temporary financial boost the Coronavirus Aid Relief and Economic Security Act allowed employers to.

Social Security tax deferral. WASHINGTON The Internal Revenue Service announced today that a new form is available for eligible self-employed individuals to claim. Track Expenses Automatically Maximize Deductions.

According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401 a of the Internal Revenue Code on net. In total self-employment taxes usually add up to 153 of a self-employed persons net earnings from self. Following some initial confusion HMRC has now updated its advice for businesses and individuals affected by coronavirus to make clear that the six-month income tax self.

Self-Employed Coronavirus Relief Center.

What You Need To Know About Self Employment Tax Deferral Taxes For Expats

Employee Social Security Tax Deferral Repayment Process

Covid 19 Tax Resource Center Tax Updates Intuit Accountants

/GettyImages-92223836-57a5356b5f9b58974ab7e971.jpg)

Trump S Payroll Tax Deferral What Should You Do

2021 Wage Cap Rises For Social Security Payroll Taxes

Maximum Deferral Of Self Employment Tax Payments

Paying Back The Covid Payroll Tax Deferrals

Coronavirus And Your Taxes What You Need To Know Ramseysolutions Com

Irs Sends Notices About Deferred Payroll Taxes Coming Due In December Accounting Today

Can I Still Get A Self Employment Tax Deferral Shared Economy Tax

Tax Deferral How Do Tax Deferred Products Work

How To Defer Social Security Tax Covid 19 Bench Accounting

How The Payroll Tax Deferral Impacts Military Members The Military Wallet

Guidance For Repayment Of Deferred Payroll Self Employment Taxes

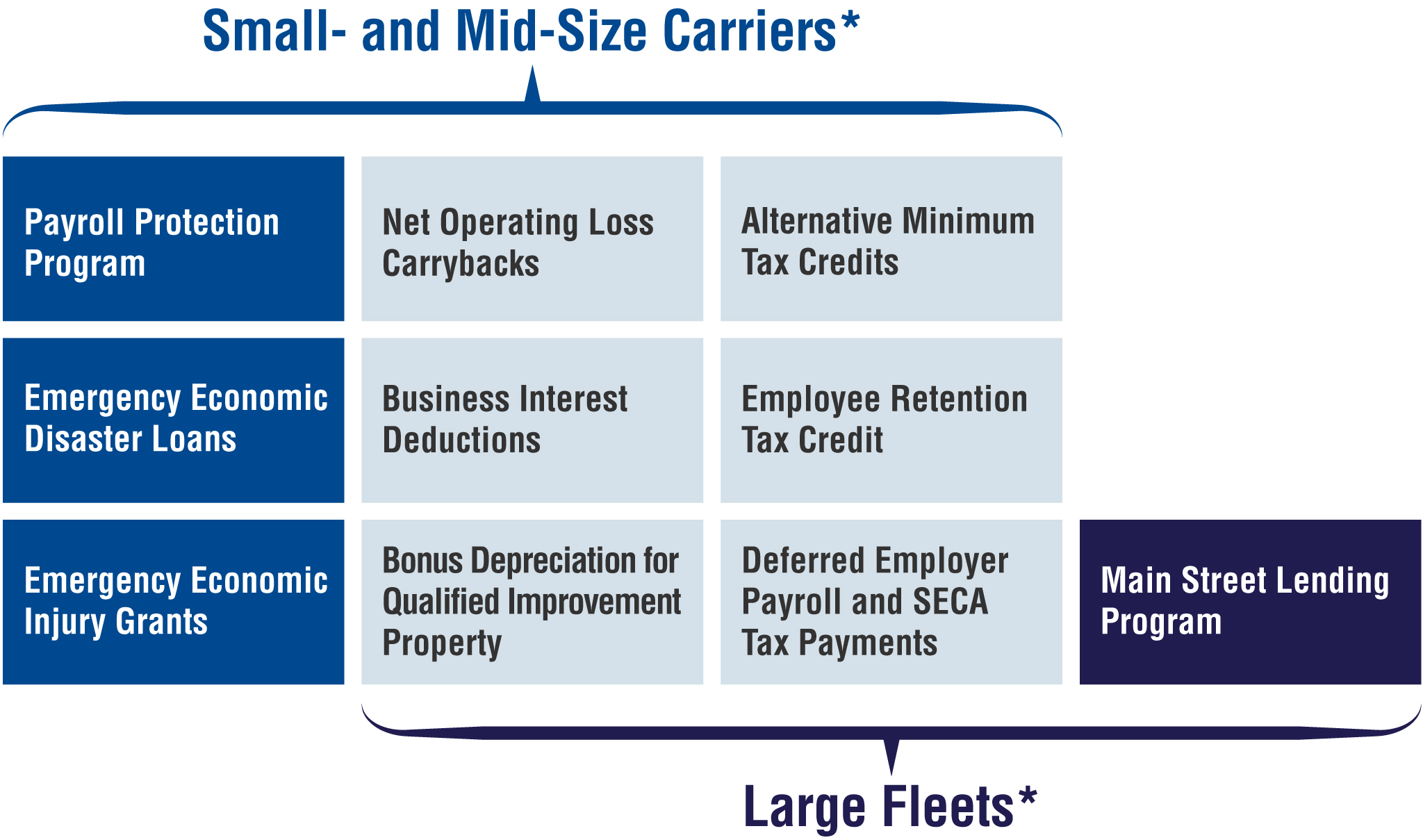

Covid 19 Financial Assistance For Businesses American Trucking Associations

5 Ways To Defer Tax Payment Obligations For Employers

Cares Act Payroll Tax Deferral For Employers

What The Self Employed Tax Deferral Means Taxact Blog

New Stimulus Bill Tax Breaks That Employees And Self Employed People Should Know Cnet