contra costa county sales tax increase

Contra Costa County Sales Tax Increase 2021. Contra Costa moves forward with half-cent sales tax measure for social services.

Editorial Yes On Two Sales Tax Measures No On Two Others

That would bring Contra Costas sales-tax rate up to around 10 percent.

. Gavin Newsom signed into law a variety of bills on Thursday including SB1349 by State Senator Steve Glazer allowing a countywide half-cent sales tax increase which is designated Measure X on the November ballot in Contra Costa. On the last day possible Gov. Sales tax increase now in effect across California by.

According to the Senate Governance Finance Committee Bill Analysis the earlier version of the bill that passed the Senate the first time would have allowed a possible increase in the countywide sales tax rate to 1175 in cities that already have a 1 sales tax such as in Antioch and as high as 1225 in El Cerrito which has a 15 city sales tax. 1788 rows Contra Costa. Several Bay Area cities saw a Sales Use tax hike go into effect on April 1.

181 below the first sales period in 2019. 1 The city increased its existing tax of 050 percent CNCD to 100 percent CNTU in addition to the Contra Costa countywide increase of 050 percent listed in the countywide table. The California state sales tax rate is currently.

On November 3 2020 Contra Costa County voters approved a half cent retail sales tax increase that will take effect on April 1 2021. Concord voters will consider Measure V which also would continue and increase an existing sales tax from 05 to 1. The Countys allocation from the countywide pool jumped up 40 a combination of new revenue from out-of-state online retailers due to the enactment of AB147 coupled with bigger online sales due to social distancing and in-store restrictions.

Essex Ct Pizza Restaurants. Half-Cent Sales Tax Hike. The Contra Costa County California sales tax is 825 consisting of 600 California state sales tax and 225 Contra Costa County local sales taxesThe local sales tax consists of a 025 county sales tax and a 200 special district sales tax used to fund transportation districts local attractions etc.

Income Tax Rate Indonesia. Triple Flip Unwind PDF Sales Use Tax Reference Manual PDF 2021. The December 2020 total local sales tax rate was 8250.

If you entered a supplemental number and it is not listed below it may be included in. It was approved. If it passes sales tax would increase by half a percent on most goods but not on necessities like food and medicine.

State Senate Bill 1349 passed and signed at the last minute allows the Countys sales-tax cap to increase from 2 effectively to at least 35 or possibly 4 in addition to the States 725 rate. Contra Costa Sales Tax Increase 2021. The 975 sales tax rate in Martinez consists of 6 California state sales tax 025 Contra Costa County sales tax 1 Martinez tax and 25 Special tax.

The Contra Costa County sales tax rate is. Opry Mills Breakfast Restaurants. Contra costa county ca sales tax rate.

Contra costa county collects a 225 local sales tax the maximum local sales tax allowed under california law contra costa county has a higher sales. A yes vote supported authorizing an additional sales tax of 05 for 20 years generating an estimated 81 million per year for essential services including the regional hospital community health centers emergency response safety-net. The Supervisors on a 4-1 vote also flashed the green light to allow county officials to proceed in drafting a county-wide ballot measure possibly for the November election for a half-cent sales tax increase to support county services.

That would bring Contra Costas sales-tax rate up to around 10 percent. A county-wide sales tax rate of 025 is. 2021 - Quarter 4 Not yet released 2021 - Quarter 3 Not yet released 2021 - Quarter 2 PDF 2021 - Quarter 1 PDF 2020.

Contra Costa County CA Sales Tax Rate The current total local sales tax rate in Contra Costa County CA is 8750. That rose to 3093 this year a 348 percent increase. The Contra Costa County Sales Tax is 025.

A new half-cent sales tax to raise an estimated 81 million a year mostly for social services moved closer to the November election ballot Tuesday but delays in passing a certain state Senate bill could still derail it. 2 The city increased its existing tax of 050 percent GZGT to 100 percent GZTU and extended the expiration date to March 31 2044. Support Placing Half-Cent Sales Tax Increase on Ballot on Split Vote.

The 2018 United States Supreme Court decision in South Dakota v. Soldier For Life Fort Campbell. Has impacted many state nexus laws and sales tax collection requirements.

Fast Easy Tax Solutions. What is the sales tax rate in Contra Costa. Restaurants In Matthews Nc That Deliver.

Had the governor vetoed the bill the votes would not have counted. Bay City News. The Contra Costa County Board of Supervisors will probably act on a.

Contra costa county california sales tax rate 2021 up to 1025. The Contra Costa County Board of Supervisors will proceed with pursuing a half-cent 20-year sales tax measure for Novembers general election ballot though it could be derailed if a bill now languishing in Sacramento isnt passed. 36 rows The Contra Costa County Sales Tax is 025.

5 consgoods 5 fooddrug adjusted for economic data 1q 2021 contra costa county uninc. Many Americans in the Bay Area are struggling financially during the pandemic but a majority of voters in Contra Costa County seem to. Contra Costa sales-tax rates already range from 825 to 975.

The most populous zip code in. Wed Jul 29 2020 1033 am. Contra Costa County Measure X was on the ballot as a referral in Contra Costa County on November 3 2020.

Contra Costa County City. El Toro Lake Forest 7750. Brentwood Los Angeles 9500.

Delivery Spanish Fork Restaurants. Net of aberrations taxable sales for all of Contra Costa County grew 18 over. The votes on that measure will now count.

Increase appropriations limit to 175 million and adjust for cost of living. Ad Find Out Sales Tax Rates For Free. Contra Costa Supes Seek Ballot Measure The tax would raise an estimated 81 million a year to pay for certain county services.

To review the rules in California visit our state-by-state guide. Original post made on Jul 15 2020. 7 the city approved a new 100 percent sbnt to replace the existing 025.

Editorial Yes On Two Sales Tax Measures No On Two Others

Measure G Puts Future Of Vehicle Abatement Program In County Voters Hands News Danvillesanramon Com

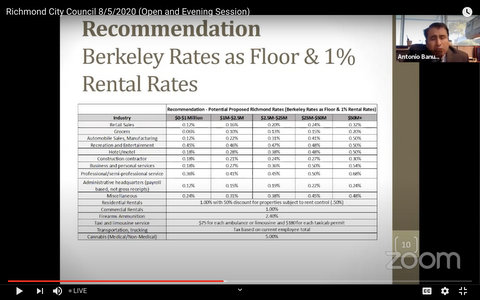

Richmond City Council Sends Gross Receipts Tax To Voters Richmond Pulse

County Assessor Kramer Working To Increase Property Tax Exemption From 7k To 100k

Connection Between Iron Horse Lafayette Moraga Trails To Be Studied East Bay Times

Editorial Yes On Two Sales Tax Measures No On Two Others

Bay Area Real Estate Recovery Creates Property Tax Appeal Opportunities

Middle Age Sprawl Bart And Urban Development Access Magazine